Digital IRS Form W-10 in PDF 2020-2025

Show details

Hide details

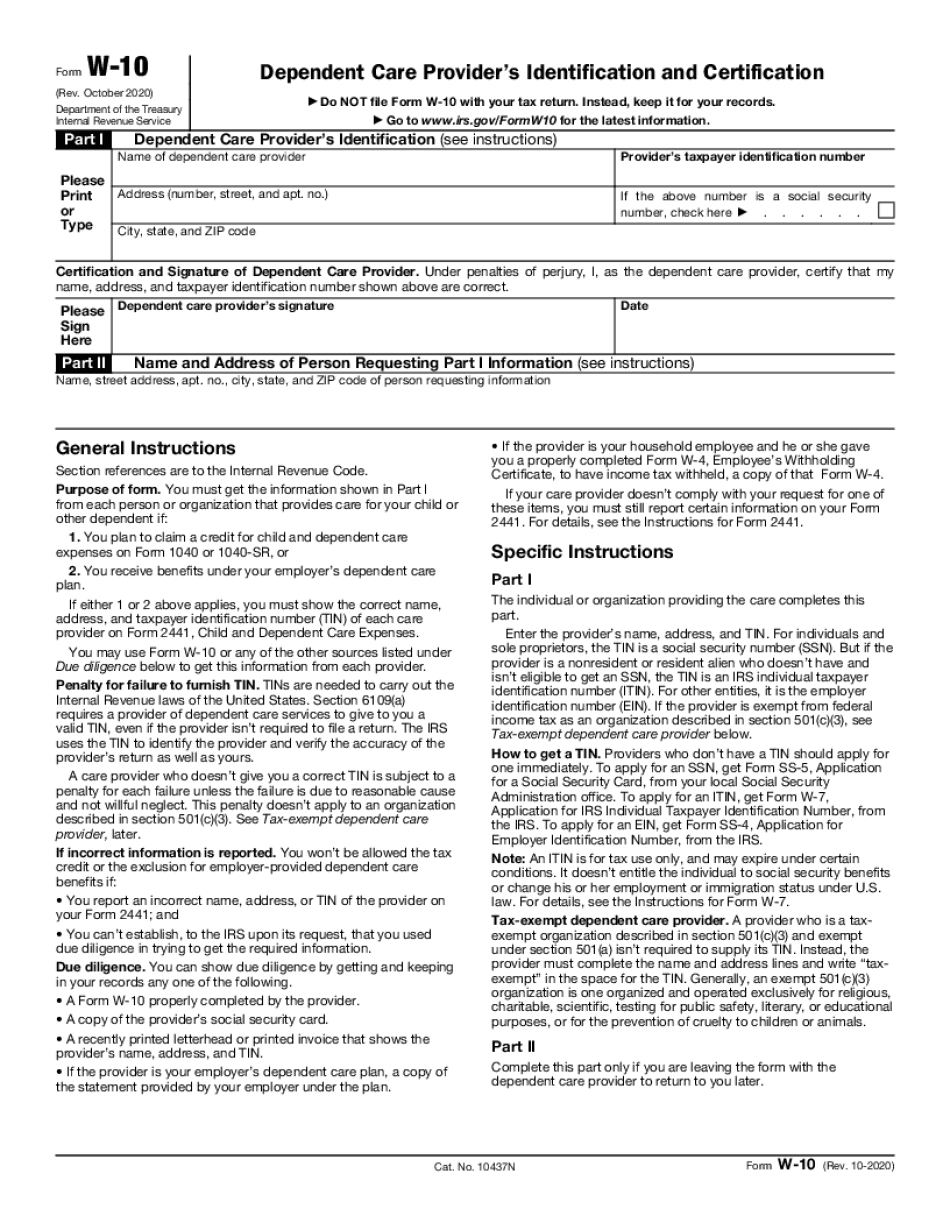

W*irs*gov/FormW10 for the latest information* Provider s taxpayer identification number Name of dependent care provider Please Address number street and apt* no* Print or Type City state and ZIP code If the above number is a social security number check here. Certification and Signature of Dependent Care Provider. Under penalties of perjury I as the dependent care provider certify that my name address and taxpayer identification number shown above are correct. Please Dependent care provider s ...

4.5 satisfied · 46 votes

form-w-10.com is not affiliated with IRS

Filling out Form W-10 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form W-10

Every person must report on their finances on time during tax period, providing information the IRS requires as precisely as possible. If you need to Form W-10, our reliable and intuitive service is here to help.

Follow the instructions below to Form W-10 promptly and accurately:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official instructions (if available) for your form fill-out and accurately provide all information requested in their appropriate fields.

- 03Complete your template utilizing the Text tool and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the toolbar above.

- 05Use the Highlight option to accentuate specific details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or remove unwanted document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or choose Mail by USPS to request postal report delivery.

Opt for the simplest way to Form W-10 and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is W10 Form?

Online solutions allow you to arrange your document management and improve the productivity of your workflow. Look through the quick information to be able to complete Irs W10 Form, prevent errors and furnish it in a timely way:

How to complete a W 10?

- 01On the website hosting the form, click Start Now and go towards the editor.

- 02Use the clues to fill out the appropriate fields.

- 03Include your individual information and contact information.

- 04Make sure you enter right data and numbers in proper fields.

- 05Carefully review the information of the blank as well as grammar and spelling.

- 06Refer to Help section if you have any issues or contact our Support team.

- 07Put an digital signature on your W10 Form Printable using the support of Sign Tool.

- 08Once blank is completed, press Done.

- 09Distribute the prepared blank through email or fax, print it out or download on your device.

PDF editor lets you to make changes in your W10 Form Fill Online from any internet connected gadget, customize it in accordance with your requirements, sign it electronically and distribute in different approaches.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form W-10?

The W-10 is a form that should be completed and returned to the IRS as soon as there is a change in the taxpayer's (including spouse's) income. This can occur after filing a return or after receiving an audit notice. It is used to prove that you were properly and correctly informed of tax matters. It records what information was provided to you by the taxpayer, the taxpayer's representatives, and/or the IRS. Furthermore, it also records all documentation required by the IRS to determine your compliance with the applicable tax laws. An individual who may qualify for the W-10 must furnish information to the IRS on a timely basis as required by the IRS. Form W-10 can be used to prove certain issues related to the taxpayer (for example, that you understand the applicable tax laws).

Who should complete Form W-10?

The Form W-10 is filed by a person who is required to file tax returns or pay taxes. Taxpayers who have income from business activities not eligible for a Form W-2 and/or not eligible for any other form of a tax return may make an election to file an amended tax return (Form 1040X), or pay the tax liability, under the provisions of section 7422 of Title 26.

Who should complete Form 1069?

Form 1069 is also filed by a person who has income from business activities that are not eligible for either an Individual Taxpayer Identification Number (ITIN) or an Employer Identification Number (EIN). Taxpayers who have income from business activities not eligible for either an Individual Taxpayer Identification Number (ITIN) or an Employer Identification Number (EIN) may make an election to file an amended tax return (Form 1040X) or to have the tax liability assigned to them. The amended tax return should bear the date the election is made.

How is Form W-10 or Form 1069 filed?

Form W-10 or Form 1069 is filed on lines 1 or 2 of a Form 1040X or Form 1040. For more information on preparing your tax return, see Publication 505, Instructions for Form 1040, or Publication 505.pdf, Instructions for Form 1040.pdf, Employer's Supplemental Tax Return by an Independent Business Entity; and Publication 515, Independent Business Entity Returns — General Information.

Note You may need to adjust your income for the tax year or years you claim on the Form W-2. See the instructions for Form W-2.pdf, Withheld Income Tax Return, for more information.

Am I required to include estimated taxes and penalties in income on the return?

No. You do not need to include estimated taxes and penalties on your tax return. You must file and pay estimated tax as required by law. If you are uncertain about whether you will owe estimated taxes and penalties, you may contact the IRS.

Which forms of payment will I be allowed to make on my Form W-2?

You will be allowed to use a personal check, money order, bank draft, credit card, debit card, or electronic fund transfer to pay taxes and any estimated tax or penalties.

When do I need to complete Form W-10?

For employees filing their taxes in-person, the deadline to complete Form W-10 is March 15.

For employees filing their taxes online, the deadline to complete Form W-10 is May 31 and April 20 for employees filing on paper: If you are not required to furnish an employee a Form W-10, you can mail Form W-10, with appropriate information, to them:

Office of the Governor

Department of Revenue

PO Box 815

Charlotte, North Carolina 285 If you are required to furnish an employee a Form W-10, you must send a request to your employee's payroll provider to receive Form W-10 and the required information.

Can I create my own Form W-10?

Yes. It's actually pretty easy. First, select “Create a Form” from the Forms menu.

Then type your desired fields into the fields list. The “Search” field is only used on the Forms view, and you can use it for your own Forms. To create the form as a template, choose “Create a Page” and type the name of your form as a name and the template name. This will create the form as an attachment in Microsoft Word. You'll need to enter all necessary information in the “Other” box for the form.

Next, you'll need to choose how to save the file. Choose “Save as PDF” for the filename. Then you can click the Save button and your file will be uploaded to your Microsoft OneDrive account and a new PDF with all the information will be created.

How do I copy and paste my forms into a Word document?

Simply click on the “+” icons for each form and select your desired option to copy the information to your Word document. To save the form as a PDF, click the Save button at the top of this page, or choose File > Save as PDF, and you'll be given your PDF file to download. Click the Download button in the lower right corner of your PDF, or right-click on the file and choose Save As to save your file as an attachment in Microsoft Word. This will download the form as a PDF attachment to your computer.

How do I make changes to my form?

The first time you create or modify your form, you'll need to fill-in all the details in the form on the page. The rest is taken care for you. Click on the Form Attributes icon to the left of a Form. Here, you can edit the Form Attributes which affect the look and feel of the form (for example, you can change the border color, font, padding, colors, size, position, opacity, border color, typeface and much more).

Next, you'll need to click on the Add Button in the left-hand side of every screen where you see a link for your form. Select your new form again, then click the Add button.

The first time you go to edit a form, the forms' editor will open. Click Add a Button and your form's fields will be added.

What should I do with Form W-10 when it’s complete?

If you received Form W-10 as a result of an unpaid tax lien, you have the option of disposing of it (either permanently or for an appropriate period of time) or, after filing your return, claiming the exemption and paying the amount due from the taxpayer's account. The IRS encourages all taxpayers to complete Form W-10 as soon as possible. In order to receive a full refund of all unpaid tax, you should have timely filed your return by the due date.

Where do I find out if a Form W-10 was issued to me, and who issued it?

The following information will help you determine whether a Form W-10 was issued:

Form W-2 Instructions for Tax Periods for which the Return is Received

You are required to file a completed Form W-2 if you have received payment from taxpayers who owe you taxes, have a tax lien, have filed for bankruptcy or had your account with a bank or other financial institution closed. If you file a Form W-2, the IRS can issue a form, refund or credit the amount of tax not paid at the time the Form W-2 is filed. A completed Form W-2 must be returned to the IRS.

Form W-10 and Refund or Credit on Form 1040

If the original unpaid tax was paid with a Form 1040 (Form 1040NR), Form 1040ES, Form 1040A, or Form 1040NR-EZ, you will receive a Form W-10 and information about the original tax liability you are entitled to receive from the IRS as an overpay or. The IRS issues this form as a refund or credit only for overpayments that were paid as described in your Form 1040. The amount of tax you are entitled to receive can be found on the back of the Form W-10, where it tells you how much is due.

Form W-10 and Refund or Credit on Your Returns

If you received a Form W-10 because you are a nonresident alien, an alien who is an employee with tax-exempt status for a tax year ending with or within which your return is filed, or any U.S. resident alien (other than a U.S.

How do I get my Form W-10?

You'll be able to get your Form W-10 by calling 1.800.487.4785 or 1.800.647.4911

The address on your Form W-10 is the mailing address from which you filed the claim for the tax credit or tax refund you claimed. When you file your Form W-10 with IRS, you'll need to use the exact mailing address and name you used to file your original Form 1040. If you filed electronically and don't have to tell us the address, give us your last full post-tax paycheck or tax return (or previous year's, if you filed electronically), which includes your Form W-4 (see Publication 3)

When you file your Form W-10 with IRS, you'll need to use the exact mailing address and name you used to file your original Form 1040. If you filed electronically and don't have to tell us the address, give us your last full post-tax paycheck or tax return (or previous year's, if you filed electronically), which includes your Form W-4 (see Publication 3) When you get your Form 1040 from the IRS, it will be stamped “Inbound” with the form number. For a copy of your Form 1040 after you've filed electronically, you'll need to order Form 1040-ES, Application for Federal Tax Credit/Refund.

In the instructions to get your Form 1040, you'll need to show your Form 1040-ES showing the amount of the tax credit you're claiming. For Form 1040-ES, you must complete and sign a separate form, showing how the tax credit was determined.

What kind of tax credit can I claim?

It depends on the tax year in which you file.

If you're filing a joint return, the maximum you can receive is the amount of the tax credit for the first 3,000 of eligible expenses you paid, or 2,000 if you both used the standard deduction. For each additional 1,000 of eligible expenses you paid up to your joint filing threshold, you can claim an additional 500 in tax credits. No tax credit is allowed in any other case. You can only claim tax credits from your refund.

What if both you and your spouse have business income of more than 100,000? Don't claim the standard deduction. See Deduction Limits, later.

What documents do I need to attach to my Form W-10?

You must attach a document that shows that you are a U.S. citizen living abroad. There are three types of documents that you can use: an I-140A, I-485, or I-873 form, the USCIS Form DS-2019, or the USCIS Form I-966. See the instructions for your specific form and how to attach it.

What are the different types of Form W-10?

Form W-10 is an income tax form, also known as a 1040 form. Form W-10 is used to file a tax return. The forms are issued by the IRS.

The forms are divided into 7 sections. The seven sections are:

Section 8(H) indicates that the payment is the “reasonable and customary value” of services performed by the self-employed taxpayer and is not taxed at the individual income tax rate. Section 8(I) indicates that the payment is “reasonable and customary if the service is not performed in a trade or business carried on by the self-employed taxpayer but is performed in a trade or business for which the employer's gross receipts are derived.” Section 48(h) indicates that the payment is not income subject to the individual income tax at the individual level. Section 14(A) indicates that the payment is an amount derived from the sale of goods or services. Section 14(A) also indicates that the payment is not subject to the individual income tax at the individual level. Section 14(E) indicates that the payment is not income subject to the corporate income tax at the individual level. Section 15(B) indicates that the payment is not subject to the individual income tax at the individual level. Section 15(A) indicates that the payment is not income subject to the corporate income tax at the individual level. Section 16 indicates that the payment must be within the calendar year for which reporting is required for the taxable year. Section 16(B) indicates that the payment must be within the calendar year for which reporting is required for the year for which filing is required. Section 26 shows the amount of the payment.

What are the different types of Form 1040X?

Form 1040X is also known as a 1040NR. Form 1040X is used to figure deductions for an individual taxpayer. If a corporation makes a payment, the corporation may claim a deduction only on Form 1040X.

Form 1040X is used to figure deductions for a corporation. If a self-employed individual makes a payment, the self-employed individual may claim a deduction only on Form 1040X.

Other than the deductions listed above, a corporation may not claim deductions for payments made to, or expenses incurred by, an employee to the extent that the employee is the owner of the corporation, or the wages are distributed in cash to the employee.

How many people fill out Form W-10 each year?

The IRS collects about 1.1 billion Form W-10 returns of taxpayers in the United States.

How many returns are returned by a taxpayer in a year?

Form W-10 serves as a form of backup or backup withholding for tax withheld during the tax year on income reported on Form 1040, 1040A, or 1040EZ. If a taxpayer's tax return is incorrectly filed for any reason, the Taxpayer Advocate Service (TAS) may request that the taxpayer return the form.

How many taxpayers with more than 500,000 in AGI reported for the tax year but whose AGI was less than 500,000, and who were not requested to file Form W-10 each year but still failed to make either two required minimum returns or one required return?

The IRS has collected data on taxpayers who had a large share of their AGI in excess of 500,000 (the 500,000 thresholds used for purposes of the tax penalty for failure to file when filing Form W-8) but who did not have either two required minimum returns or one required return.

How many taxpayers with more than 500,000 in AGI reported for the tax year who were not required to file a Form W-8, and who did not file a Form 1040?

The Taxpayer Advocate Service (TAS) reports that in the 2010 and 2011 tax years, the IRS completed more than 1.2 million requests for information from taxpayers who had a large share of their AGI in excess of 500,000 (500,000 thresholds used for purposes of the tax penalty for failure to file when filing Form W-8). More than 2.4 million returns from taxpayers that had a substantial share of their AGI in excess of 500,000 were filed. In addition, these returns have been assigned an Individual Taxpayer Identification Number or ITIN. Only the IRS reported any data about this group of taxpayers in the 2010 and 2011 tax years. Therefore, these data should not be used to provide information about IRS processing actions on Form W-10.

If a taxpayer receives an IRS letter and has a large share of his or her AGI in excess of 500,000 but did not file a Form W-8, the taxpayer must file a second tax return within 6 months immediately, and must make either two required minimum returns or one required return.

Is there a due date for Form W-10?

The form must be received by the IRS on or before the IRS due date.

What information do I need to file a Form W-10?

For tax years 2017 and earlier:

Required information for your return, including the tax year, the year's income, and the type of income;

Monthly estimated income for the year;

Your Social Security number or a Taxpayer Identification Number;

Details of your pay;

Any deductions for which you are claiming or will be claiming credits or if you have other tax credits available;

Pay stub on Form 1099-MISC

Employer identification and pay stubs, such as one from an employer that lists your income and withholding rates

Optional information from you or your employer, such as Form 8963.

What information are you responsible for providing on Form W-10 if you are self-employed?

You must report all income that you received in the year from all sources on the line for “Other income (not income taxes).” The line should include your W-2s and Form 1099s and should not report the gross amount. If you received more than 800 in gross wages and more than 8,000 in self-employment income you may have to file a self-employment tax return. See Self-Employment Tax Return for more information.

Do I have to complete the self-employment tax return?

If you are self-employed (or you are a partner in a partnership or qualified 1099-MISC, as discussed earlier), you are required to file Form 1040 or Form 1040NR. To reduce your estimated tax, you may qualify for a refund of 50 per person for all combined net self-employment and tax credits received.

If you receive wages on a regular schedule, you must complete the schedule as provided in the instructions for Schedule SE if your net self-employment income is more than 25,000. This is true even if the wages are not on a regular schedule. See the Instructions for Schedule SE (Form 1040).

If you receive wages on a special schedule, you must have the schedule showing the gross wages before you file a Form 1040. You may be able to complete the schedule on Form 1040NR. See Form 1040NR Instructions and Schedule SE Instructions, also see the Instructions for Forms 1040 and 1040A.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here