When I first took a step back and decided to address my feelings and questions

I now consider myself a “fully functioning ADHD adult” and an expert on this topic (in addition to being a licensed medical doctor). When I first took a step back and decided to address my feelings and questions about ADHD, I became fascinated with the idea of “receipts.” Receipts give us a great deal of insight into our life and our past. Receipts teach us how to be better parents and spouses. Receipts hold so much significance in your life, it is very easy to ignore them; however, they are not going to get ignored anytime soon. If you are struggling with ADHD, how you think and feel about your life can be a direct reflection of what happens in your head—from the unconscious thinking processes of your mind that drive your behavior—to the thoughts and words that come out of your mouth and lips. As I moved into a full understanding of myself, I began to realize that my ADHD, my thoughts and reactions, my behavior, mood, and sense of self, is all connected, intimately. There is no “me,” there are, instead, “us,” “my” reactions, and “my” thinking. As you continue to understand yourself better, your personal and professional experiences will follow a different course, and you will come away with a fresh set of eyes, new understanding, and valuable guidance. My Story — My Life With ADHD As a child my parents were very involved in my growth and development. They believed in my ability and desire to be all I could be — a great student, a loving.

See the video below and see how to file TurboT ax's 2441 form by just clicking

In order to simplify matters, TurboT ax can do it for you. Here's how. See the video below and see how to file TurboT ax's 2441 form by just clicking on the button to the.

W-9 990 990 Form W-8B 2 — Fill out Tax Form Tax Deductible IRA/Roth IRA/Tax

W-9 990 990 Form W-8B 2 — Fill out Tax Form Tax Deductible IRA/Roth IRA/Tax Free Savings Account (FSA) The Internal Revenue Service (IRS) requires you to report the amount of your distributions from any Tax-Free Savings Account (FSA) or Tax-Yield Deduction Account (FDA) to the IRS. The IRS will withhold federal income tax at the federal level. However, the state's higher state tax may be greater and may be subject to additional state income taxes, especially when the distributions are made in your IRA. If state taxes are not withheld, your distributions could result in a negative federal income tax on the amount of the distributions. Do not list state taxes separately from your gross income. These distributions have to be reported as the total amount of distributions to the IRS. For more information, you can view the information on Distribution From a Tax-Free Account below. Note: As of April 1, 2015, the IRM has eliminated the use of the term “taxable year of birth” and replaced it with “taxable year of birth.” Taxable Years of Birth Tax Years of Birth 2018 – 31 2017 – 15 2016 – 20 2015 – 19 2014, 2015 or 2016 if it is a distribution from a Tax-Free Savings Account: Tax Year in which you are age 65 or older, or you were age 65 or older. Tax years with a base filing status other than single or head of household must include the year you reached your target filing status Nonfiling due to the death or inability to file (not an emergency) must also be.

This means that you may be exempt from federal income taxes if you live in one

This federal form is a reminder of some main facts to look for: Who can file it? You may qualify if you are covered by an exemption or exemption application from someone else. The IRS may accept the application if you have other, similar forms that show that you qualify. This means that you may be exempt from federal income taxes if you live in one of the following: a foreign country, where personal income taxes are not required , where personal income taxes are not required a state that has no income tax a commonwealth, territory or possession of the United States or any of its possessions, which have no income tax a political subdivision or independent political subdivision of a commonwealth, territory or possession a province, autonomous area or territory under the authority of Canada or a political subdivision or independent political subdivision of Canada a Canadian province, autonomous area or territory, or an American state (The United States and American states have no income tax.) (The United States and American states have no income tax.) a foreign federal province or territory or the European Union (In Canada, the U.S. federal state or Canada has no income tax, and the EU has no income tax. The EU includes Ireland.) This applies to the country you are in, the county you are in, the state in and the county in which you live. But it does not include the province or territory of Guam or Puerto Rico. That can be a significant difference. Who can't file.

VIA's Caregiver Resource Page | VA's Caregiver Resource Page VIA Help for

VIA's Caregiver Resource Page | VA's Caregiver Resource Page VIA Help for Caregiver-Aged Veterans in the D.C. Area Help is not the only thing you can do for your caregiver when they return from their tours of duty. In Washington, D.C., there are a number of resources available. These include: Veterans of all wars, occupations, and specialties have provided service to their country on various levels. Many have become caregivers for military members, veterans, and others. As you transition to adult life, make sure your caregiver is aware of all their services, including those in which they may have become vested. VIA Help for Caregiver-Aged Veterans in the Philadelphia Area If you are a veteran in the Philadelphia area, it may seem like you have it all. After all, you are now able to live an independent life and have full Social Security benefits. Don't forget about your caring responsibilities as a caregiver. There are many things to do on the weekends or holidays. One of the best things you can do is to make sure your family knows that you are available and involved in your health care. Learn more about Philadelphia's Veterans Community Resources VIA Help for Caregiver-Aged Veterans in the Pittsburgh Area While you may be fortunate to live in the Pittsburgh-area, there are also many things to do there. It is a great town to walk and bike. It has many great restaurants and bars. You may be able to find work that you love. As you grow older, you will be living much of.

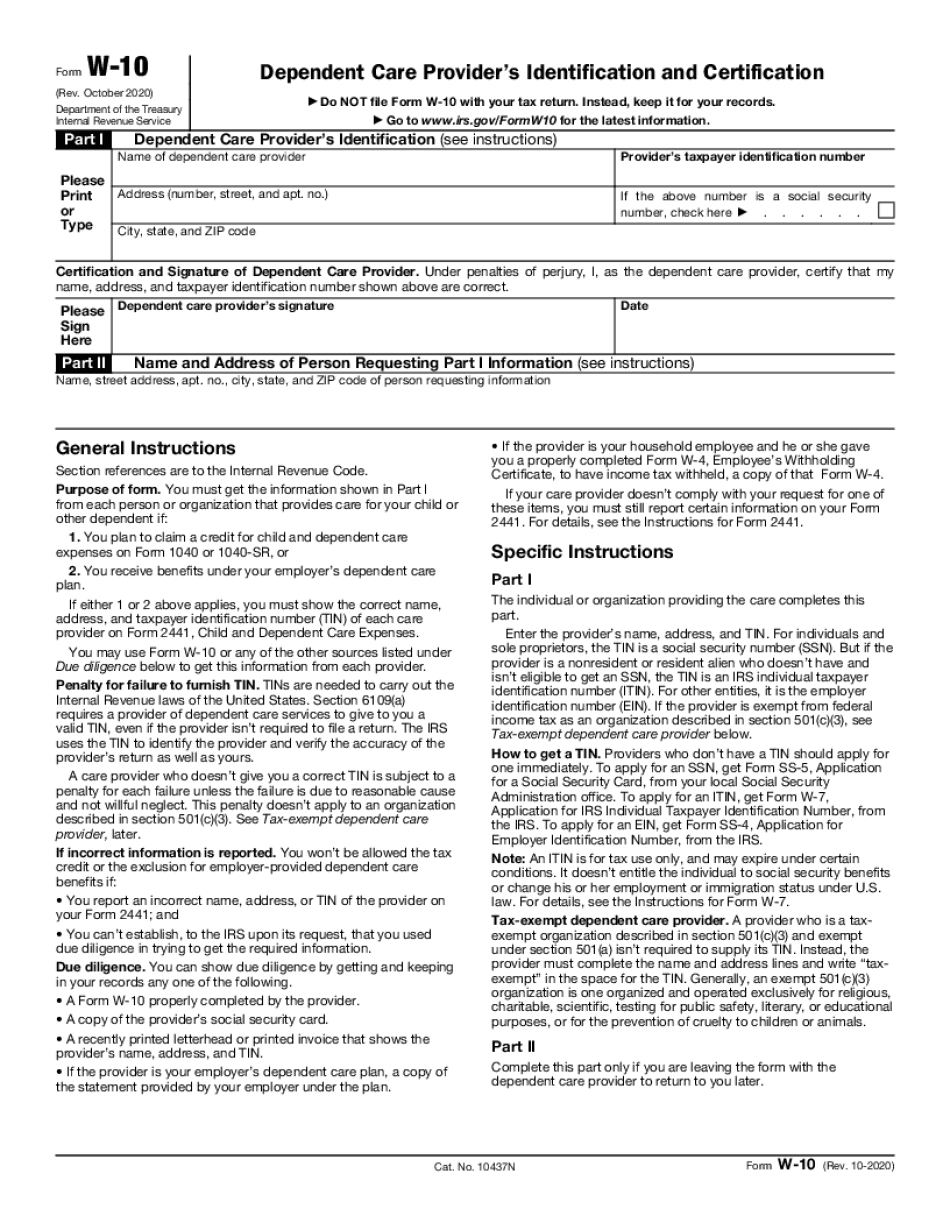

The IRS W-10 Form — Child and Dependent Care Credit — Fill Out and Sign

The IRS W-10 Form — Child and Dependent Care Credit — Fill Out and Sign Form W-10 Form — Fill Out and Sign Printable PDF Form W-10 Form W-8 Form W-9 The Child and Dependent Care Credit for 2017 and 2018 (PDF) The IRS W-10 Form. The Child and Dependent Care Tax Credit.

Award-winning PDF software