Hi, my name is Laura Piccata and I'm back with another video. Today's topic is all about how to keep more of your money because there are three components to money. One is knowing how to earn it, two is knowing how to keep it, and three is knowing how to grow it. Today, I'm going to teach you a strategy that will help you keep more of the money that you're making, and it's going to include your kids and taking all of their expenses and writing it off on your taxes. This way, you can quit paying taxes and give that money to your kids. Now, you have to be a hundred percent your child's parent, but the strategy can also work with nieces, nephews, and grandchildren. However, there is a slightly different approach. So, I recorded a separate video going over just that, and I'll leave a link for it in the description. Now, if you don't know a little bit about me, I'm a real estate investor. In my business, I don't just focus on implementing strategies that will help me make more money, but I also focus on implementing strategies that will help me keep more of the money that I make. One of the ways to achieve this is by actually having my daughter involved in my business. And also, for the strategy to work, you have to have a business entity set up. So, if you're not necessarily in the real estate investing business, this can also work, but you do need an entity. Whether you have an LLC, S corp, or even if you are a sole proprietor, it's all going to work. I'm just going to show you how to implement the strategy differently based on which entity you have. Okay, so if you're...

Award-winning PDF software

Dependent care expenses 2441 Form: What You Should Know

Where Can I Get IRS Form 2441 Now? Where Can I Get IRS Form 2441? If you've filed your federal income tax return and want to be sure it includes the amount of the child and dependent care expenses you claimed on your return, get your Form 2441 now from the following locations: Who Can File Form 2441? You can claim the child and dependent care credits on your federal tax return.

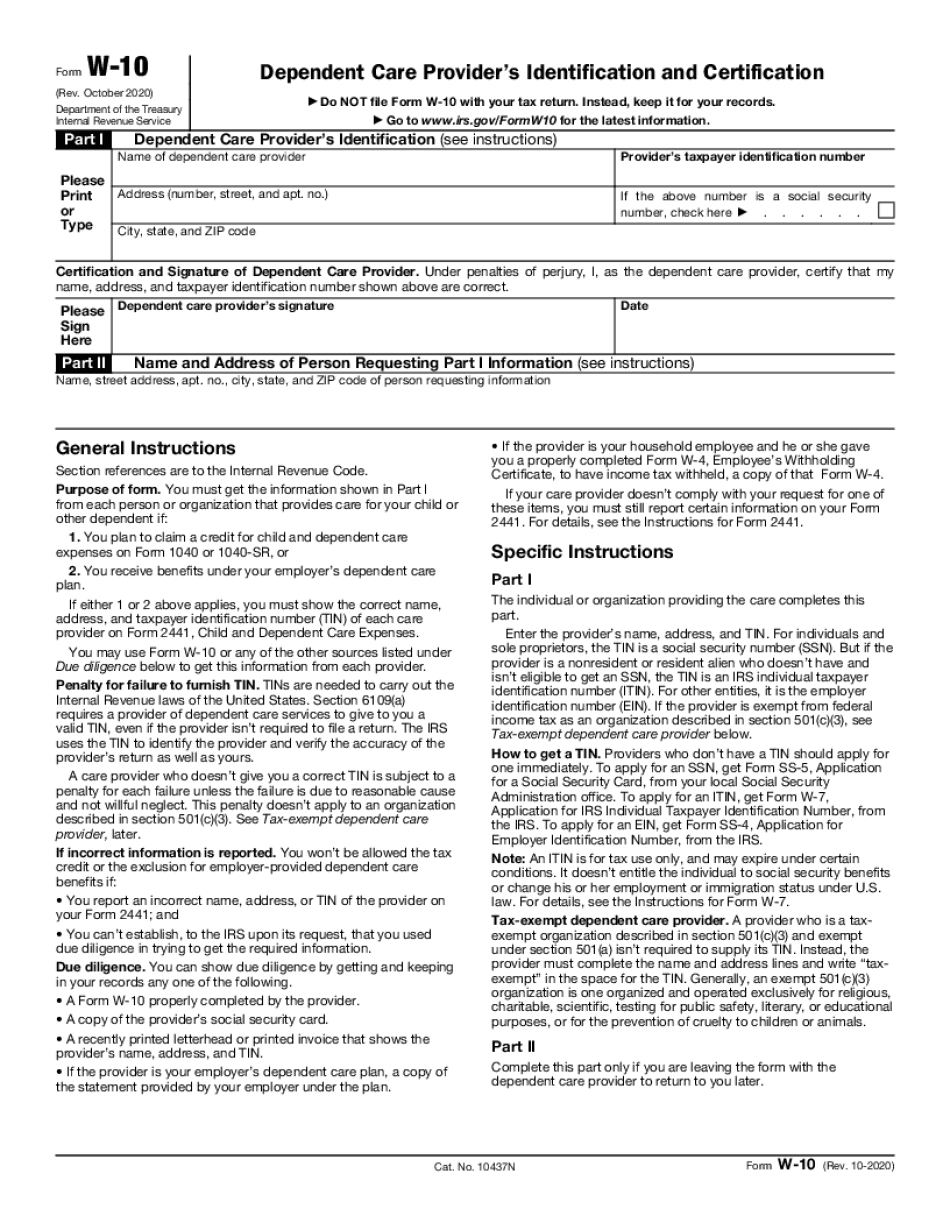

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-10, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-10 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-10 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-10 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dependent care expenses form 2441