Alle booboo, the former Harris, is now Beecher. - Is it wise to apply for an ITIN number for tax purposes? - While I tried to file my paperwork, does it hurt? - Assuming you are married to a citizen, you're going to get a work permit. - In a few months, you won't really need the tax identification number if you're married to a citizen. - Music, you.

Award-winning PDF software

Itin number for illegal immigrants Form: What You Should Know

How to get an ITIN and more on Form W-7 A tax return cannot be submitted with an ITIN. An ITIN is issued in support of a person's Individual Taxpayer Identification Number — New Orleans Public Library ITIN's are issued to non-U.S. citizens who meet the following requirements: • A U.S. citizen, as defined at 49 U.S.C. ITIN's, or • Are 18 to 50 years old, and meet all other requirements to be issued an ITIN. Your name is your unique identification number. You don't need an IRS-number when you use the form to Who gets an ITIN? In general, individuals from any nationality are eligible for an ITIN, and The IRS gives out It can allow you to work in the U.S. to help pay taxes. An ITIN issued by the IRS does NOT mean that you have been granted permission to work in the U.S. for the IRS. If the ITIN does not designate you as a foreign worker or alien. You should talk to the U.S. Consular or Immigration Officer in your country of citizenship, that issued your original visa to determine whether you will be allowed to work in the U.S. ITIN is available for immigrants and their dependents. To order an item, go to IRS.gov or ask your tax preparer Why get an ITIN? Tax IDs (also known as ITIN's) are issued to immigrants who want to work or claim tax credits in the U.S. and to dependents who are eligible to tax credit. Form W-7 is a one-page application form that is used by immigrants and their dependents to request tax IDs. The form needs a few pages to fill out and is available by calling Immigrants and their dependents seeking tax IDs need to provide their identification codes before they are issued an ITIN. Once an ITIN is issued, it may be used as the identification code in the tax returns of the immigrants and each of their dependents. To find out your ID code, enter your date of birth below. The IRS will tell you what ID code is required for you. You can find your ID code by entering your last and first name below.

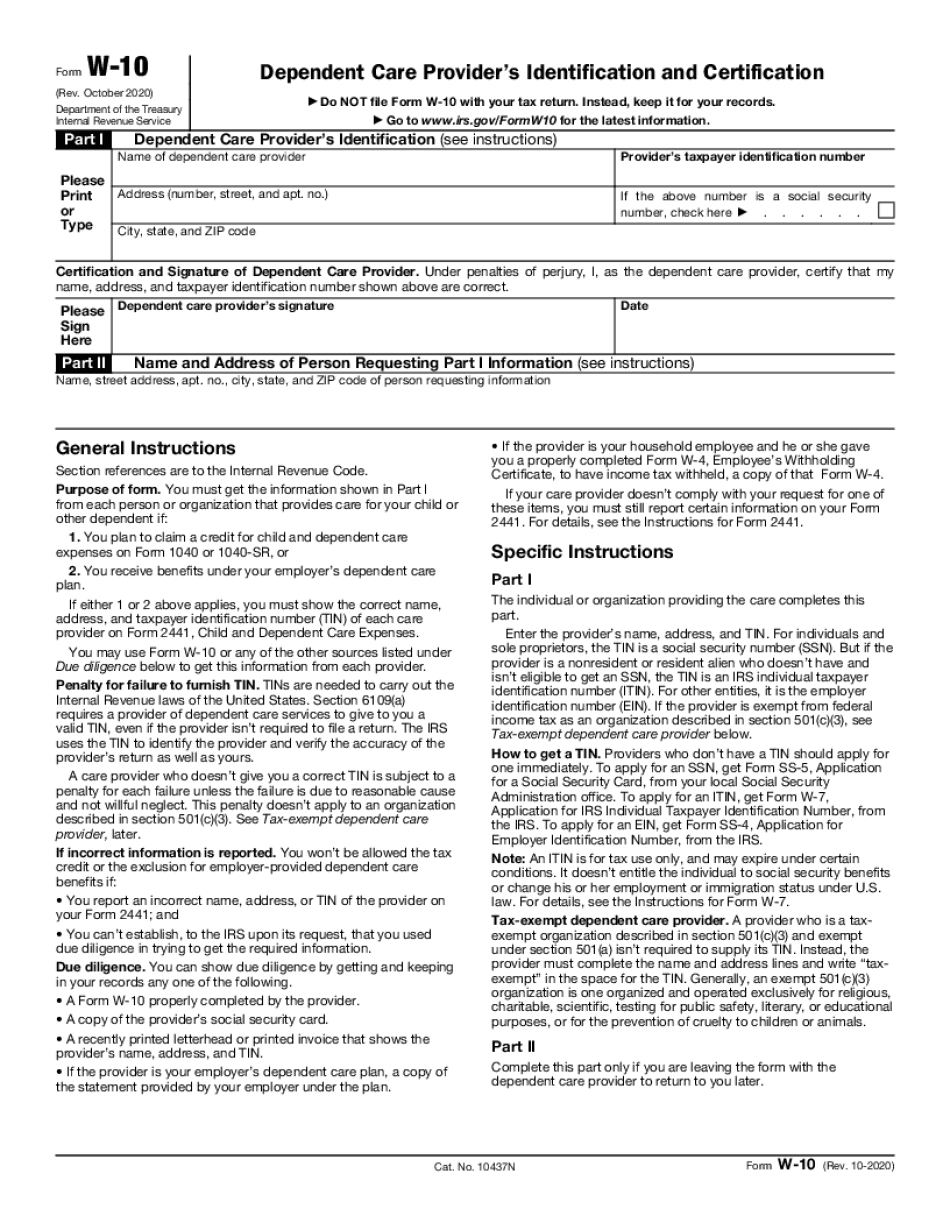

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-10, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-10 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-10 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-10 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Itin number for illegal immigrants