This strategy of saving income tax for 2014 applies specifically to individuals who have children and are paying for childcare. The childcare deduction is determined by the income of the lowest earner within the family unit, typically the husband and wife. It is also influenced by the age of the child. It is important to be aware of the maximum deduction amount allowed for each child and to obtain receipts for the childcare expenses. If there is an opportunity to supplement the childcare amount, it is advisable to actively seek those receipts. Additionally, it is crucial to negotiate with the childcare provider to ensure that the receipts obtained can be used for income tax purposes. This strategy is applicable for the 2014 tax year. If you require childcare services during the holidays, it is recommended to carefully choose the most suitable option in order to obtain receipts.

Award-winning PDF software

Child care receipt for tax purposes Form: What You Should Know

Email form to parents. Child Care Year End Receipt for Parents — 123 Learn Curricula Child care tax forms can be printed out. There are lots of different templates, from basic to detailed. I recommend using templates that were created during or Child Care Year End Receipt for Parents — 123 Learn Curricula Childcare Tax Forms for Adults — IRS When doing your taxes, what are you most concerned about when preparing a child care tax return? What is the tax form you use most? Where do you get the forms? Childcare Tax Forms for Adults— IRS Child care tax forms for adults are available online at IRS.gov, or you can download them from your state's Department of Revenue to give to your parents Childcare tax forms for adults must include the tax year income and expenses, all the information needed for your own tax calculation that will determine what you will pay, and your federal tax refund amount. There is a form for every state and territory and the forms are all available in an alphabetical Childcare Year-End Receipt for Parents —123 Learn Curricula Child Care Receipt Forms — IRS Are child care receipts needed for each child? For each child? If so, are the forms for children of different ages required? Yes, all 3 children are tax forms for child care parents. I use child care receipt forms for both adults and children, so any receipt for children that includes their parents' names are all child care forms. Child Care Receipts — Fill Online, Printable, Fillable, Blank How to Prepare a Childcare Payment Tax Return — IRS These are my tax forms for providing 1,000 of child care costs to a family for one child. My own child care receipt form works fine for this. Child Care Payment Tax Returns — IRS Where can I get forms for childcare payments? The best way to go is to look on IRS.gov if you don't know where to find child care services. If none of them are for your area, you can try using social services for some answers, or call the Childcare Payment Tax Hotline and tell the clerk “I need to get these receipts for myself and my other child(men).” Call to get the forms.

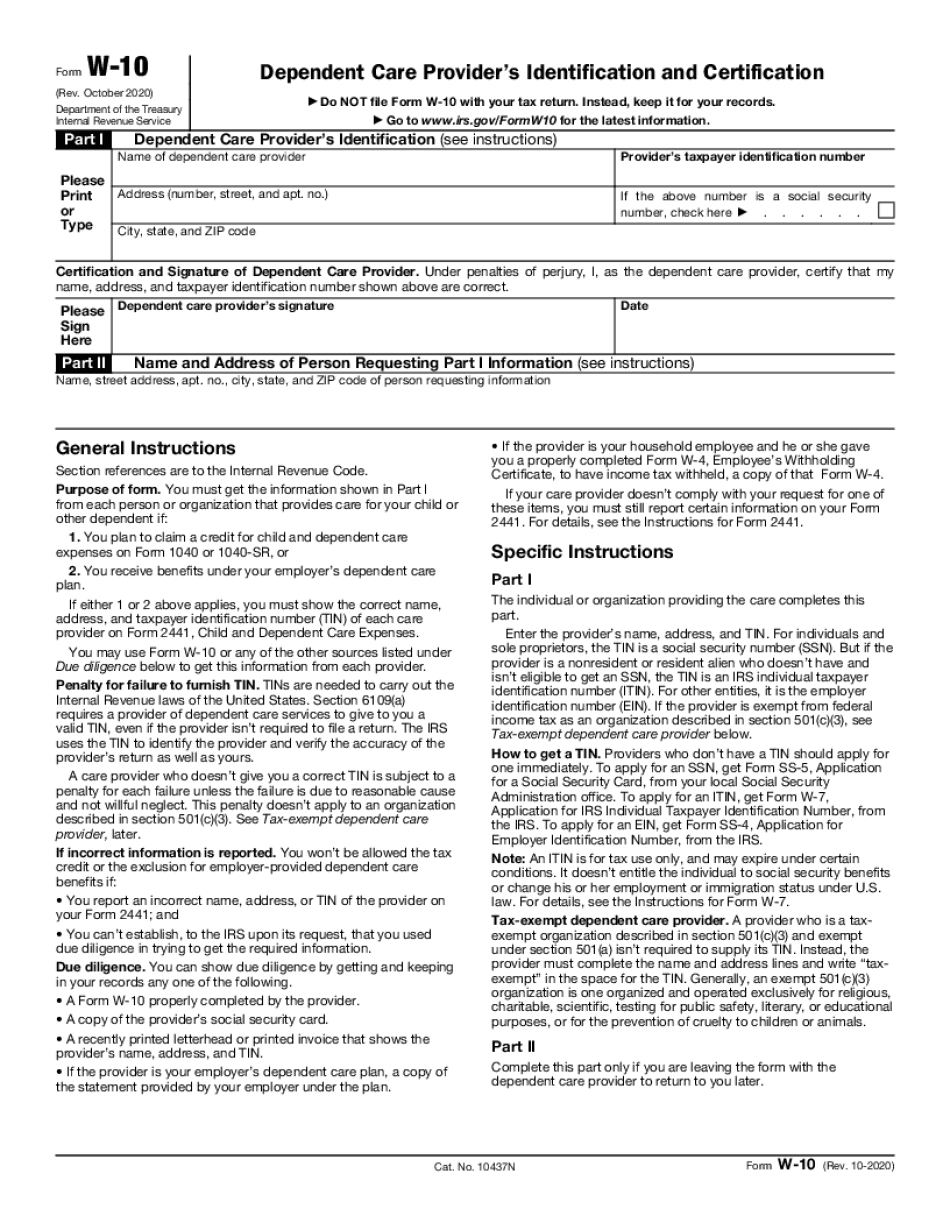

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-10, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-10 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-10 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-10 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Child care receipt for tax purposes